Is trading for you?

Are you new in trading?

If you are new to the trading game, you may have some unanswered questions. What should I trade? Which broker is the best for me? What trading style is the best one for me? How much money do I need to start? And so on. Let’s take these questions and I will give you informations that could help you decide.

What should I trade?

When you are going to trade for the first time, try it on a demo account. Why? Because you can experience real market without any risk. It’s a great way to get comfortable with trading platform and trading itself. You want to get better understanding of differences between various markets in order to choose one which suits your character.

There are many aspects of which you can decide about an ideal instrument for you. First analysis should be on you, your strong and weak sides. Can you control your emotions? Can you decide quick? How much time can you spend on trading? Can you follow rules? How much are you willing to risk?

If you have answers to questions listed above, we can choose the right instrument for you.

Volatility for you?

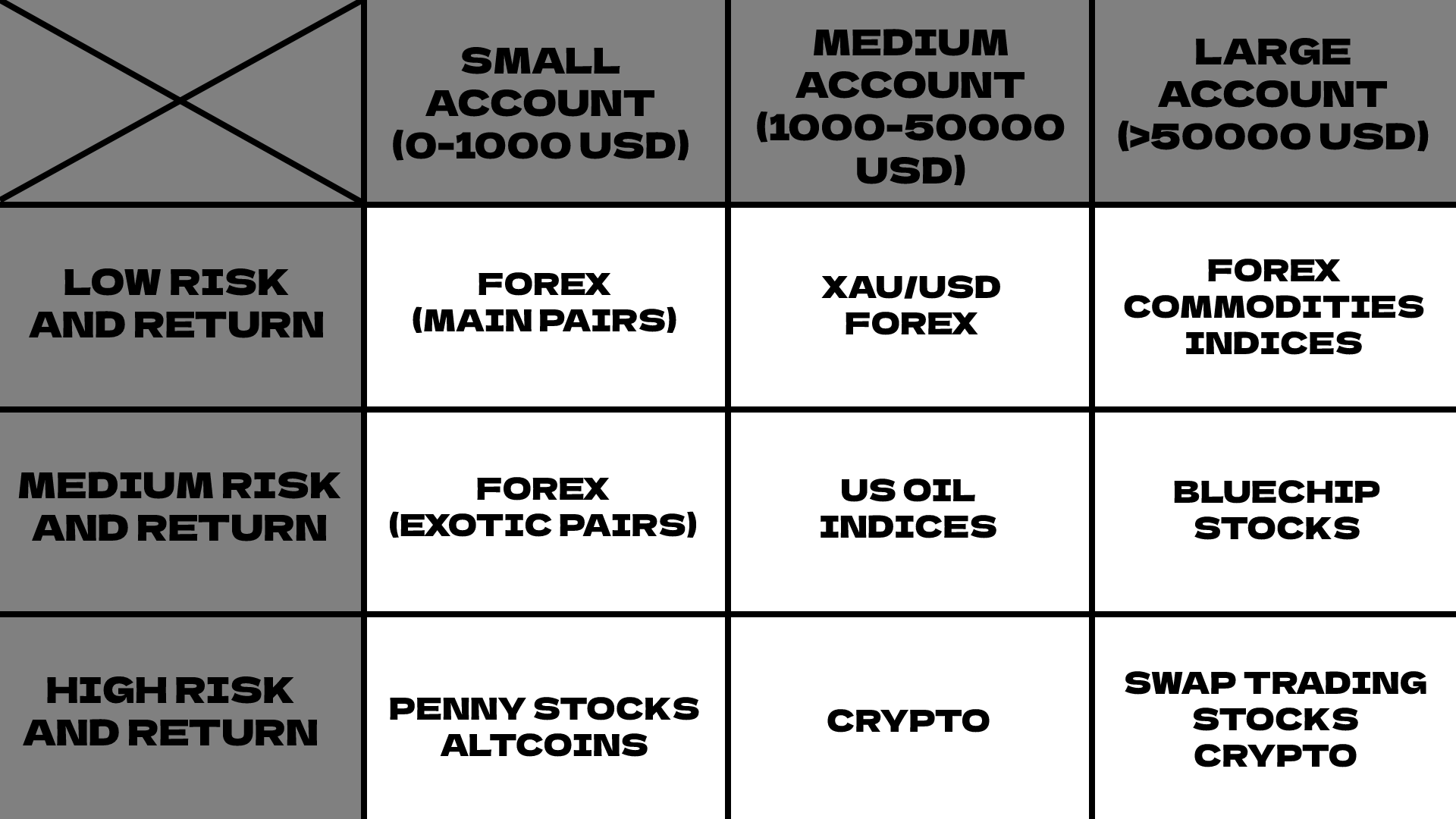

Let’s start with choosing right volatility for you, some markets have higher volatility then others. What does that mean? Higher volatility markets moves in bigger ranges, which mean that your money won’t sleep. Downside is that higher volatility means more risk. If you’re starting with small account under 1000 USD and you want to trade swings or position trades on bigger time frames, you should look for less volatile markets, in order to have enough space for Stop-losses and proper money management. On the other side, traders that are looking for more action should look for higher volatility. This typically includes scalping and trading on smaller time frames.

You can find some inspiration in the table above. Keep in mind that higher volatility = higher risk and vice versa. Also choose based on the size of your account, for small accounts margins on some instruments are just too big and risky. In my opinion the best instrument for start with small account is some main forex pair(EUR/USD, USD/JPY, USD/CAD, etc.).

Time frame for you?

When choosing a right time frame for you, you should look on multiple aspects. Firstly, smaller time frames doesn’t need as much capital as bigger does. In trading you can choose anywhere from 1 minute to monthly time frames. Smaller the time frame is, quicker you must decide and plan the next move. If trading isn’t your full time job (which at the start usually isn’t) it’s better to start on higher time frames, which don’t need as much attention as smaller ones. But also you can trade 2 hours a day on one minute time frame. Find what is the best for you.

Swing, scalp or position?

There are different attitudes to trading.

The most known style of trading is intraday trading. It means, that you don’t hold positions more then one day (you go sleep with no open positions). Every beginner should try it.

You can wait for the big move and enter only for few minutes to make a good profit, this includes bigger positions and quick reactions. This style is called scalp trading or scalping.

You can trade swings, which is a bigger price move in one certain direction, swings are traded mostly on hourly and daily time frames. Swing trading is statistically the most profitable style of trading.

You can become a position trader. Then you would focus on daily, weekly and monthly time frames. If you’re looking for more peace and less action choose this one. Also you can use swaps in a big way here. Some positions are held for several months or even years.

These are the main styles of trading, there are some more, which represent the middle ground between those above.

Conclusion?

These informations are based on my knowledge and experience. If you are new to the trading game I would recommend you to read a book about trading in general to have easier start.

The book I would read if I was starting over would be Trading for a Living: Psychology, Trading Tactics, Money Management by Dr. Alexander Elder.

written by Filip Lemon